Based on the purpose of “Supporting People and the Earth through Seating Technology” we will continue to

provide both

social and economic value. In addition, we have set “A company that is kind to people and nature" as the basic

philosophy of our environmental policy, and in May 2022, we agreed with the TCFD (Task Force on Climate-related

Financial Information Disclosure) recommendations. Analyze risks and opportunities that our business poses from

climate change scenarios, provide feedback to strategy and risk management, and lead to an increase in corporate

value.

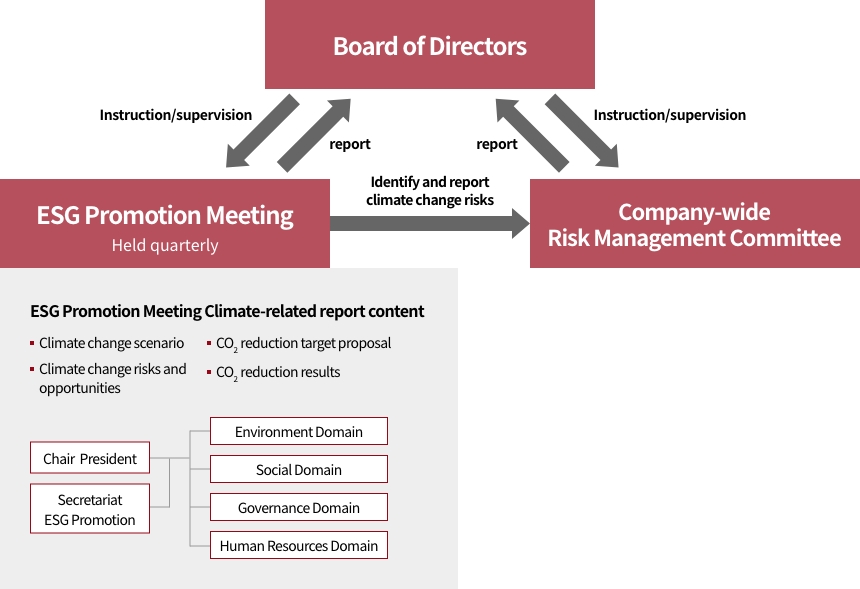

Governance

We are continuously implementing CO2 reduction activities to address climate change issues, with the core

of our

corporate activities being “Supporting People and the Earth through Seating Technology”. Regarding these

initiatives,

the ESG Promotion Meeting, chaired by the president, approves the activity policy and follows up on the progress of

each quarter. The contents of the ESG Promotion Meeting are regularly reported to the Board of Directors and reflected

in activities Under the direction and supervision of the Board of Directors.

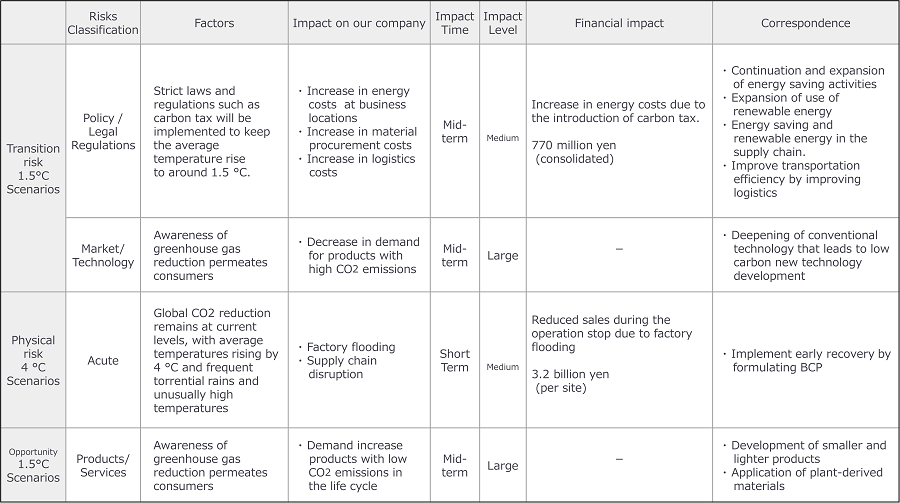

Strategy

We examine scenarios in which the average temperature at the end of this century will rise by 4°C compared to

pre-industrial levels, and scenarios in which the temperature will be limited to a 1.5 °C increase, and we extract

climate-related risks and opportunities for our businesses. The following is a list of climate-related risks with

high-risk ratings based on the evaluation by the company-wide Risk Management Committee.

Referenced scenarios

4°C : IPCC RCP8.5 IEA STEPS Public Policy Scenario, CPS Current Policy Scenario

1.5°C : IPCC RCP2.6 IEA SDS Sustainable Scenario, NZE 2050 Substantive Zero Scenario

Impact period : Short term → within 3 years, medium term → around 2030, long term → around 2050

Impact level : Calculated from the likelihood of occurrence (5 levels) x financial impact (5 levels)

Based on the results of scenario analysis, we will reflect the newly necessary measures in our management strategy,

work to strengthen the resilience of our business, and effort to disclose information.

Risk Management

Climate change risks are identified at the ESG Promotion Meeting, and the company-wide Risk Management Committee

reviews them regularly once a year, including climate change risks. Evaluate the importance of risk by "damage scale"

and "frequency of occurrence" when risk occurs, and the contents are reported from the Risk Management Committee to

the Board of Directors.

In reaction to the risk assessment, the relevant subcommittees set measures to be taken and target values. We are

promoting risk management activities.

Risk Management

Metrics & Targets

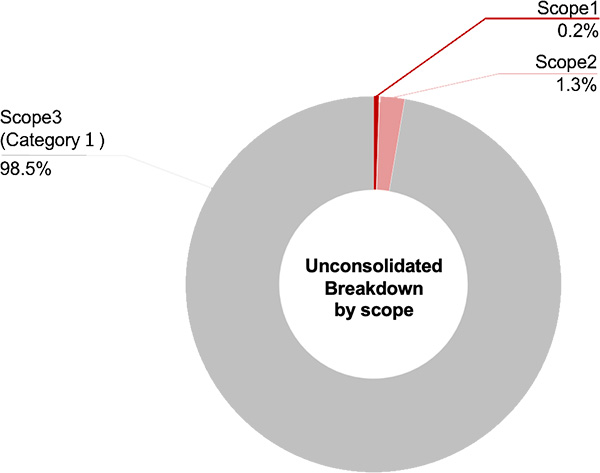

Aiming for carbon neutrality in 2050, we have set the following as indicators and intermediate goals.

Trends in greenhouse gas emissions (By scope)

2030 target

- Scope 1 and 2 CO2 total emission reduction (domestic ) : ▲ 46% compared to FY2013

- Scope 1 and 2 CO2 total emission reduction (overseas ) : ▲ 43% compared to FY2019

- ※1Scope 2 emission factors Japan, Central and South America, and parts of

China:

Market standards other regions: Location standards

- ※2Calculated from Scope 3 "Emissions intensity database ver3.2 for calculating

greenhouse gas emissions of organizations through the supply chain“, category 1 to 8 are calculated and

category 1

accounts for 95% or more, so only category 1 is listed.

- ※3Compliant with the Japanese government's GHG reduction target

- ※4Compliant with IPCC Recommendations (April 2022)