Basic Approach to Investor Relations (IR)

The TACHI-S Code of Ethical Practice clearly states, ‘The Company enhances management efficiency to meet shareholders’ and investors’ expectations, and places importance on the investor relations (IR) to promote the understanding of its corporate management and activities through correct and timely IR activities.’ Guided by this policy, we disseminate corporate information such as management strategy and financial information in a timely, fair, accurate, and continuous manner.

Code of Conduct Regarding IR Activities

- Members of the Company shall have bold and original ideas, and appropriately execute their plans, to meet shareholders’ and investors’ expectations.

- Members of the Company shall disclose business performance results appropriately, give notice of the management philosophy, management policy, and measures for improving business performance clearly, receive any opinions or criticism sincerely, and reflect them in management.

Shareholder Return Policy and Situation Regarding Shares

We believe that providing returns through ongoing enhancement of corporate value is an important management issue and have adopted a basic policy of maintaining stable dividends while at the same time augmenting shareholders’ equity and improving profitability. The Company primarily utilizes internal capital reserves for R&D and global business development and endeavors to secure profit in the medium to long term and strengthen its financial structure.

We have adopted DOE (Dividends on Equity) as our main financial index for dividends. Transformative Value Evolution, our medium-term business plan covering FY2021-2024, contains a policy of issuing dividends with a DOE of 3-4%. The Board of Directors decided to stipulate in the Articles of Incorporation that the Company can use retained earnings for dividends. The Company has set a basic policy of paying two dividends a year, namely an interim dividend and a year-end dividend.

In FY2022, an annual dividend of 73.6 yen per share was paid. The Company also offers special benefits for shareholders once a year at the end of the fiscal year. We will continue our efforts to enhance corporate value while also providing further returns to shareholders.

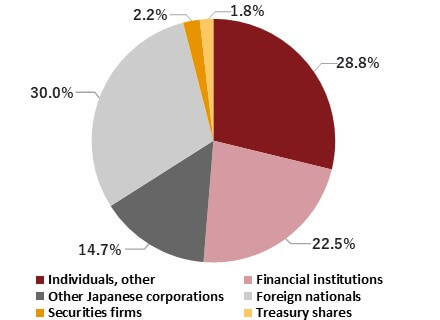

Shareholder composition (as of March 31, 2023)

Information Disclosure and IR Activities

Basic Stance on Timely Disclosure

TACHI-S CO., LTD. (the “Company”) strives to increase society’s trust in and promote understanding

of corporate activities through fair and timely information disclosure in order to meet the expectations of

shareholders and investors. The Company will disclose information in accordance with relevant laws and regulations,

including the Companies Act and the Financial Instruments and Exchange Act and the Timely Disclosure Rules of the

Tokyo Stock Exchange, and will voluntarily disclose information that the Company regards as necessary and useful to be

understood, even when none of the above applies.

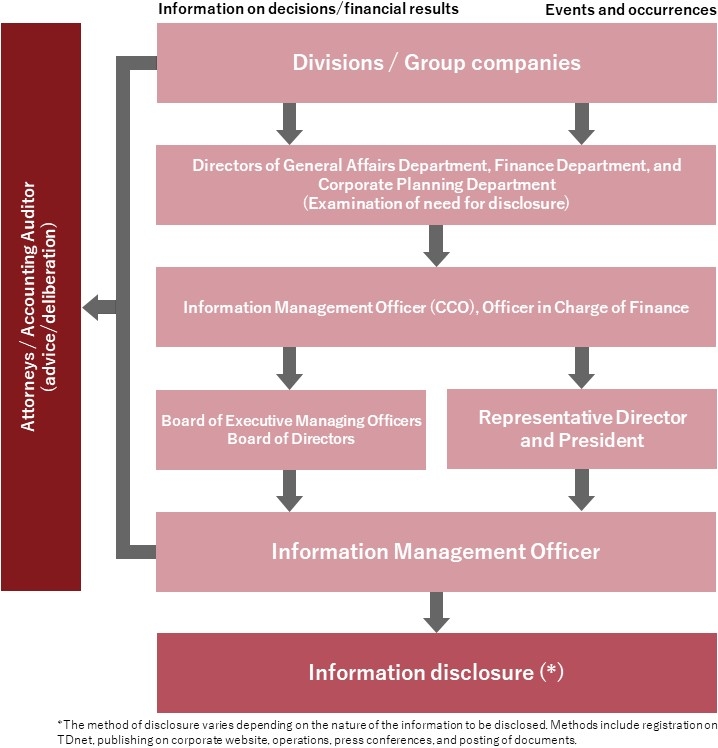

Internal Framework for Timely Disclosure

The Directors of the General Affairs Department and Finance Department and the General Manager of the Corporate

Planning Office will deliberate on the need for disclosure of information, including that of subsidiaries, concerning

decisions, events and occurrences, and financial results and obtain the approval of the Information Management

Officer, after which the information will be disclosed upon a resolution by the Board of Directors and the Board of

Executive Managing Officers (“Board of Officers”).

For material corporate information, after consultation with the relevant departments, including accounting and

finance, legal, corporate communications, R&D, and production, a determination of whether the information should

be subject to timely disclosure will be made according to the Tokyo Stock Exchange’s Securities Listing

Regulations, and, upon the approval of the Representative Director and President, a decision will be made on the

content, timing, and method of publication of the information. In response to this decision, as a general rule, the

President or a person duly nominated by the President will make the disclosure of the information, which will be

managed by the department responsible for corporate public relations.

The Company will disclose documents in accordance with related laws and regulations, including the Companies Act and

the Financial Instruments and Exchange Act, using an appropriate method, and will also promptly publish the same

material on the Company’s website following disclosure. In addition, regarding the disclosure of important

information applicable to the Timely Disclosure Rules stipulated by the Tokyo Stock Exchange, the Company will

disclose through the Timely Disclosure network (TDnet) provided by said Exchange in accordance with said rules while

promptly publishing the same material on the Company’s website following disclosure. Even when disclosing

information that does not apply to the Timely Disclosure Rules, the Company will disclose it in an appropriate manner

in light of the purpose of timely disclosure.

Disclosures concerning “Decisions,” “Financial Results,” and “Events and

Occurrences” will be considered and decided according to the following process.

Disclosure process for important information

| Content of Disclosure |

Disclosure Process |

| Decisions |

Important information concerning management will be resolved by the Board of Directors, and important matters

for the execution of operations other than matters resolved by the Board of Directors will be resolved by the

Board of Executive Managing Officers. Proposals to be put to the Board of Officers will be subjected to prior

examination by the Directors of the General Affairs Department and Finance Department and the General Manager of

the Corporate Planning Office, after which the Information Management Officer will determine whether or not

disclosure is required. If it is determined that disclosure is required, the Information Management Officer will

report the content of the disclosure to the Board of Officers and disclose the information promptly following

the approval of the proposal in question.

|

| Financial results information |

The financial results information for each quarter will be prepared by the Director of the Finance Department

based on information from the individual departments and Group companies and, after examination by the officer

in charge of finance, the resolution will be approved by the Board of Officers. The Information Management

Officer will disclose the information promptly after the Board of Officers has approved the resolution of the

proposal. |

| Events and occurrences |

Events and occurrences recognized by individual departments and Group companies will be subjected to examination

by the Directors of the General Affairs Department, the Finance Department, and the General Manager of the

Corporate Planning Office, after which the Information Management Officer will determine whether or not

disclosure is required. If it is determined that disclosure is required, it will be reported to the

Representative Director and President, after which the Information Management Officer will disclose the

information promptly.

|

*The method of disclosure varies depending on the nature of the information to

be disclosed. Methods include registration on TDnet, publishing on corporate website, operations, press conferences,

and posting of documents.

*The method of disclosure varies depending on the nature of the information to

be disclosed. Methods include registration on TDnet, publishing on corporate website, operations, press conferences,

and posting of documents.

IR Activities

For the enhancement of corporate value, the Company conducts a range of IR activities, guided by the basic policy of

holding proactive dialogue with shareholders and institutional investors and striving to nurture their trust.

Regarding the disclosure of IR information, financial information is disclosed on the corporate website on a quarterly

basis, and a presentation meeting is held to explain the financial results to analysts and institutional investors.

From FY2022, presentation meeting is held after the interim financial results in addition to after the annual

financial results. IR information will also be provided in English versions in principle to ensure fairness and

transparency. Individual meetings are also held as required.�The Annual General Meeting of Shareholders is held in

June every year. A notice of convocation of this meeting is sent out at an early stage to give shareholders sufficient

time to deliberate on the proposals being put to the General Meeting of Shareholders. The notice of convocation is

also published on TDnet and the corporate website in advance of its being sent out.

To provide non-Japanese shareholders, who account for approximately 30% of all shares, with swift and fair information

disclosure, English-language materials (summaries) will be published at the same time.

Major annual IR activities

| Financial Results Presentation Meeting (for institutional investors and analysts) |

Twice a year |

| Public release of financial results presentation |

Twice a year |

| IR interviews (individual meetings) |

As required |

| Information disclosure on website |

As required |